The evidence of economic growth in a country is prosperity and opportunities. For citizens, economic growth fueled by employment would ultimately lead to the emergence of economically viable citizens which should grow pressure for improved governance, as it’s certain that strong economic growth advances human development.

Aside from economic growth being the most powerful instrument for reducing poverty and improving the quality of life in developing countries, individuals, small and medium businesses have continued to falter in playing their part due to limited financing options to handle basic investments for their sustenance.

Attempting to change the situation, the Central Bank of Nigeria (CBN) made it mandatory for traditional banks to give out 60 percent of deposits as loans to stabilise the economy.

Despite fining banks that fail to make up the quota, it is still a herculean task for banks to meet the target, largely due to the various bottlenecks from the lenders as individuals and business owners find it hard to access the loans.

This led to the creation of financial entities that wanted to change the negative situation and play a pivotal role in stimulating economic activities and fostering financial inclusion.

One is SeedFi, a digital-first loan company that emerged to be the catalyst for the country’s economic growth by providing short and long-term basic loans to both Small and Medium Enterprises (SMEs) and individuals.

Empowering SMEs for long-term success is a sine qua non for SeedFi as it holds the view that SMEs are the backbone of any thriving economy, contributing significantly to employment and innovation. With focus on inclusivity and accessibility, it asserts that supporting SMEs with the financial resources will ensure their long-term sustainability.

Another feature of SeedFi is its flexible repayment terms, as SMEs now have the flexibility to manage their cash flow effectively, and tailoring repayment terms to align with business cycles, contributes to the stability and growth of these enterprises.

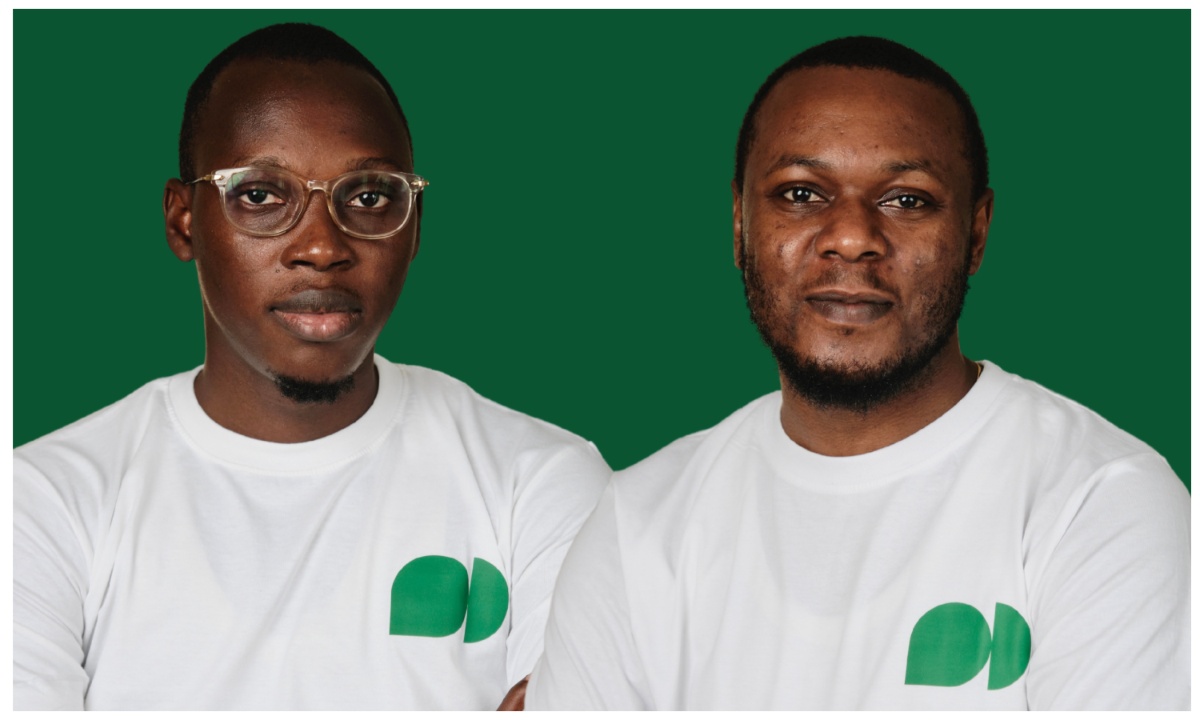

Founder and CEO, Pelumi Alli said they want to be the plug for business owners who need capital as SMEs face challenges in securing loans from traditional banks due to stringent requirements. SeedFi is filling the gap by offering straightforward application processes and approval in record time, thus making capital more accessible.

‘’By offering basic loans with competitive rates and flexible terms, SeedFi is reshaping the lending landscape, one client at a time. Whether you are an individual with urgent personal needs or a small business owner seeking financial support, SeedFi is here to empower you on your financial journey.

‘’With capital infusion, SMEs can strategically expand their operations, explore new markets, and invest in technology. This not only benefits them but also contributes to overall economic expansion’’, Alli added.

SeedFi co-founder, Samaila Dogara said providing financial support to individuals is also big with them, as the firm is instrumental in addressing short-term financial needs. Whether medical fees, unexpected expenses, education or home improvements, these basic loans empower individuals to navigate life’s uncertainties, he enthused.

He stated that their short-term loans are designed to provide quick access to funds immediately for relief during financial emergencies by ensuring a swift and hassle-free application process, allowing individuals to access funds whenever they need them the most.

Dogara said the short-term loans act as a financial safety net that help individuals to manage urgent costs without long-term burdens, thereby building financial resilience. This in turn enhances overall economic stability as individuals and businesses can weather financial shocks more effectively.

SeedFi positioning has got thumbs up from satisfied customers such as the CEO, Mwanga Candles and Diffusers, Omoyeni Disu, who said: “Seedfi has a seamless process. They took their time in explaining how it all works, it took about 2 days from advisory to completing my transaction. As a business owner, I recommend.”

As SMEs thrive and individuals navigate financial challenges with their support, SeedFi asserts that a positive ripple effect is created throughout the economy, which will be evident in jobs creation, increase in consumer spending power, and availability of a flourishing entrepreneurial ecosystem to serve as driving force for sustained national economic development.

With the proliferation of the Buy Now Pay Later (BNPL) platforms, SeedFi believes that the citizenry can access its basic short-term loans to meet its social needs. For more information, visit https://theseedfi.com/

Short-term loans to long-term impact: SeedFi’s transformative role in Nigeria’s economic landscape