The Federal Competition and Consumer Protection Commission, FCCPC, has said several illegal digital money lenders (DMLs), known as loan apps, use wallets on Payment Solution Service Providers’ platforms to execute their transactions.

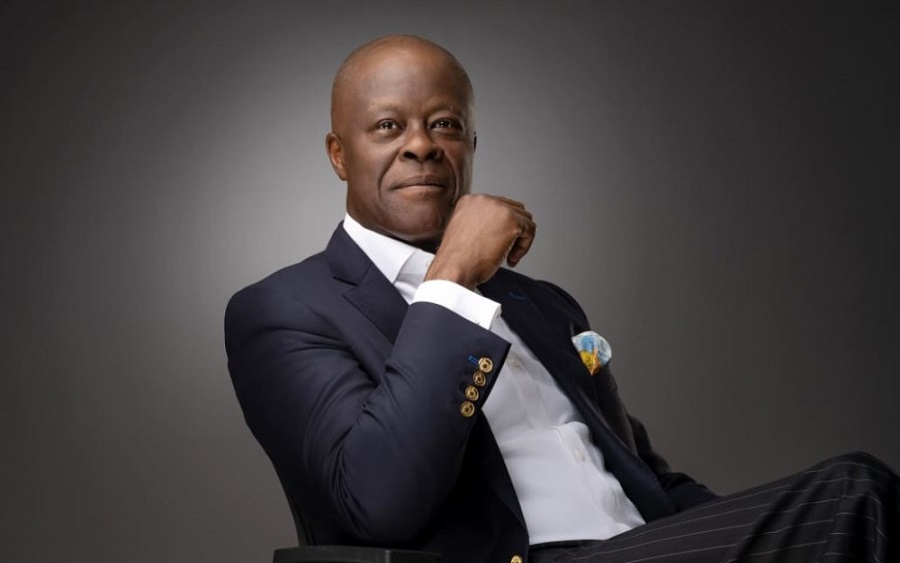

The Commission’s Chief Executive Officer, Babatunde Irukera, disclosed this recently while reacting to a call by the Nigeria Inter-Bank Settlement System to banks to delist PSSP, Switches and others from payment options.

Four days ago, DAILY POST reported that NIBSS asked Deposit Money Bank to delist PSSP from its outward payment channels.

However, FCCPC said it is difficult to halt the operation of PSSPs despite their efforts.

According to him, while the DMLs operate online, they move their transactions to PSSPs wallets once their bank accounts are frozen.

Also, reacting to a post on X alleging that FCCPC’s officials are allowing the illegal DMLs to continue to operate because they were taking bribes from them, Irukera described the allegation as false, adding that there is no way to stop the operations of the digital lenders.

“No way to stop DMLs operating. They spring up daily in different places on the internet using APKs, and when bank accounts are frozen, they operate by wallets through PSSPs. We are chasing every day, but we will never stop them all. Nothing to do with bribes, please.”

Illegal loan apps use PSSPs to executive transactions – FCCPC