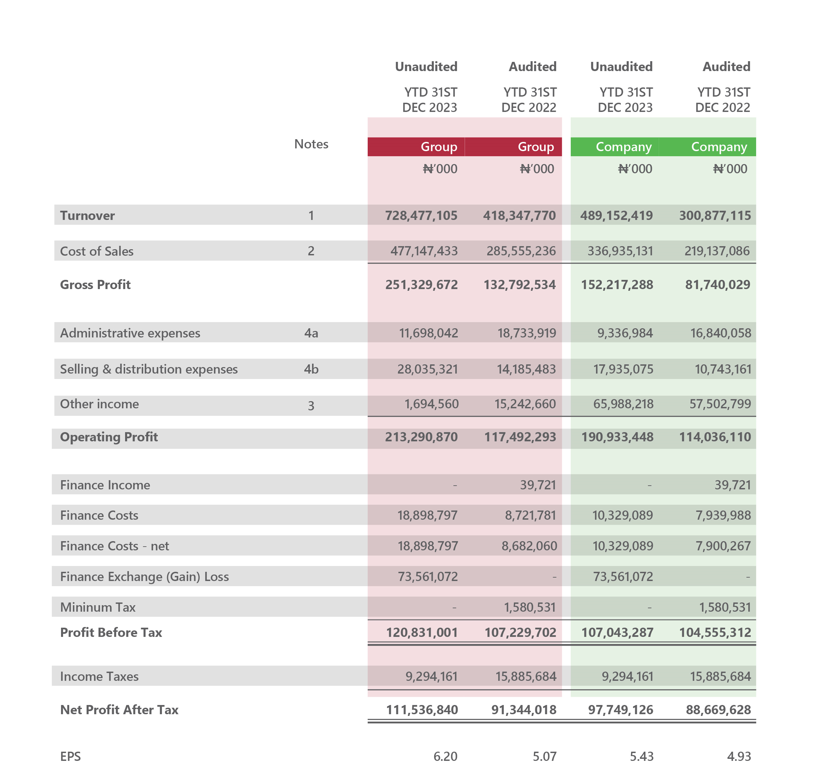

Turnover grew by 74% to NGN728.5billion. Profit After Tax grew by 22% to N120.8Billion for 12M 2023.

Lagos, 31st January 2024 – BUA Foods Plc (“BUA Foods”, or “the Company”) announced its results for the

unaudited Q4 and 12M financial for the period ended 31 December 2023.

Key Financial Highlights

|

|

Group | ||

|

In thousands of naira |

12M 2023 | 12M 2022 | Δ |

|

Revenue |

728,477,105 | 418,347,770 | 74% |

|

Cost of Sales |

477,147,433 | 285,555,236 | 67% |

|

Gross Profit |

251,329,672 | 132,792,534 | 89% |

|

Gross Margin (%) |

34.5% | 31.7% | 280bps |

|

Selling and distribution expenses |

28,035,321 |

14,185,483 | 98% |

|

Administrative expenses |

11,698,042 | 18,733,919 | -38% |

|

Total operating expenses |

39,733,363 | 32,919,402 |

21% |

|

Other income |

1,694,560 | 17,619,161 |

-90% |

|

Operating Profit |

213,290,870 | 117,492,293 | 82% |

|

Opex to Income Operating profit margin |

5.4%

29.0% |

8%

28.0% |

-33% |

|

Finance cost |

18,898,797 | 8,721,781 | 116% |

|

Foreign exchange Loss |

73,561,072 |

– |

– |

|

Profit before income tax |

120,831,001 | 107,229,702 |

12.6% |

|

PBT Margin (%) |

16.5% | 25% | 900bps |

|

Income Taxes |

9,294,161 | 15,885,684 | -41% |

|

Effective tax rate (%) |

7.7% | 14.8% | – |

|

Profit for the period |

111,536,840 | 91,344,018 | 22% |

|

Earnings Per share (Kobo) |

6.20 | 5.07 | 22% |

|

Return on Equity (%) |

42.6% | 39.5% | 7.8% |

|

Return on Assets (%) |

15.2% | 15.0% | 1.3% |

|

Total assets |

734,071,883 | 607,224,625 | 21% |

|

Total equity |

261,498,176 | 230,961,336 | 13% |

|

Total liabilities |

472,573,707 | 376,263,289 | 25% |

Commenting on the results, Engr. (Dr.) Ayodele Abioye, the Managing Director, said:

“This is a solid performance in the face of an unending challenging macro environment. BUA foods delivered strong growth despite the persistent devaluation of the naira during the period, which led to a substantial and negative impact of foreign exchange losses. Despite the margin squeeze on operating profit to 82%, our business remained resilient to deliver bottom line growth of 22% to N111.5Bn.

Our expansion strategies across all frontiers continue to crystallize in supporting growth. We remained committed to accelerating delivery in alternative and local raw materials sourcing across all our operating units, this is including the BIP project for sugar development as a softening opportunity to rely less on forex.

As we look ahead, our integrated supply chain execution strategy will continue to be strengthened to sustain the delivery of growth across our financial metrics. We are confident in our plans for the year 2024 in the face of the business climate uncertainties.

We remain committed to creating long term value to all our stakeholders and staying true to our creed of nourishing lives.”

Key Highlights of Group performance and financial review of 12M unaudited.

Revenue grew by 74% y-o-y to ₦728.5 billion in 12M 2023 (12M 2022: ₦418.3 billion). This was due to a y-o-y increase of 53% in Sugar to ₦421.5 billion (12M 2022: ₦275.2 billion), 152% in Flour to ₦216.9 billion (12M 2022: ₦85.9 billion), and 54% in Pasta to ₦87.9 billion (12M 2022: ₦57.2 billion).

Increase in cost of sales (+67%) to ₦477.14 billion in 12M 2023 (12M 2022: ₦285.55 billion) was driven by an increase in raw materials cost and energy cost. The high input cost environment and further devaluation of the Naira against the US Dollar weighed heavily on prices for raw materials. This resulted in higher cost of production.

Gross profit increased by 89% to ₦251.32 billion in 12M 2023 (12M 2022: ₦132.79 billion) even as gross profit margin appreciated by 280bps to 34.5% in 12M 2023 (12M 2022: 31.7%) due to the slight selling price adjustment within the year.

Selling and distribution expenses increased by 98% to ₦28 billion in 12M 2023 (12M 2022: ₦14.1 billion) due to huge increase in cost of diesel within the period.

Administrative expenses also declined by 38% to ₦11.6 billion in 12M 2023 (12M 2022: ₦21 billion) driven majorly by the decrease in general expenses (-58%) to ₦2.23 billion in 12M 2023 (12M 2022: ₦5.38 billion)

Total operating expenses increased by 20% to ₦39.7 billion in 12M 2023 (12M 2022: ₦32.9 billion) on the back of increase in selling and distribution cost along the supply chain to customers.

EBITDA increased by 81% to ₦223.3 billion in 12M 2023 (12M 2022: ₦123.3 billion), driven by growth in gross profit. Also, EBITDA margin appreciated by 120bps to 30.6% in 12M 2023 (12M 2022: 29.4%).

Operating profit grew by 82% to ₦213.2 billion in 12M 2023 (12M 2022: ₦117.4 billion) benefitting from top line growth driven by price adjustment and volume increase due to capacity expansion for IRS. Operating profit margin appreciated by 100bps to 29% in 12M 2023 (12M 2022: 28%).

Finance charges grew by 116% to ₦18.89 billion in 12M 2023 (12M 2022: ₦8.68 billion)

Profit before tax increased significantly by 12.6% to ₦120.8 billion in 12M 2023 (12M 2022: ₦107.2 billion) , however, profit before tax margin stood at 16.6%.

Profit after tax grew by 22% to ₦111.5 billion in 12M 2023 (12M 2022: ₦91.3 billion). while the Earning per Share (EPS) grew by 22% to N6.20 in 12M 2023 from N5.07 in the corresponding period.

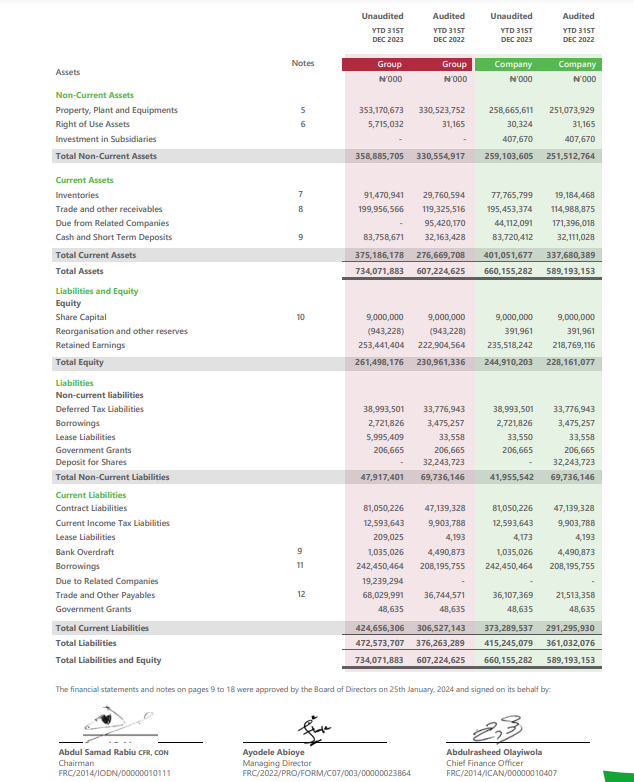

Total assets increased by 21% to ₦734billion as of 12M 2023 (FY 2022: ₦607.2 billion) driven largely by strategic transactions in trade and other receivables

Total liabilities increased by 25% to ₦472.5 billion as of 12M 2023 (FY 2022: ₦376.2 billion).

Total equity increased by 13% to ₦261.4 billion as of 12M 2023 (FY 2022: ₦376.2 billion) mainly due to a significant growth of 13% in retained earnings to ₦253.4 billion as of 12M 2023 (FY 2022: ₦222.9 billion).

Operating segment performance

Sugar division

The Sugar division contributed 58% to revenue in 12M 2023 (12M 2022: 66%). Sugar Revenue grew by 53% to ₦421.5 billion in 12M 2023 (12M 2022: ₦275.2 billion). The increase in revenue is due majorly to price adjustments within the period. Volume sold increased marginally by 5%.

Flour division

The Flour division contributed 30% to revenue in 12M 2023 (12M 2022: 20%). Revenue increased by 152% to ₦216.9 billion in 12M 2023 (12M 2022: ₦85.9 billion). The growth in revenue is due both to volume increase and price adjustment within the period. Contribution margin also increased to 27% from 18% for the same period last year due to higher selling price.

Pasta division

The Pasta division contributed 12% to revenue in 12M 2023 (12M 2022: 14%). Revenue increased by 54% to ₦87.9 billion in 12M 2023 (12M 20202: ₦57.2 billion). The increase in sales volume is due to gradual commissioning of new pasta production lines. There was also a 16% increase in production volume to 129,062 tons in 12M 2023 (12M 2022: 111,577 tons).

Rice division

The rice division debuted in 2023 contributing marginally to revenue. The total of N2.1 billion was generated from its operations. The challenges in the paddy supply chain for rice production affected the plans for full commercialization, however, we are working with local farmers to bolster the effectiveness of the paddy supplies and optimize operations in 2024.

Statements of Profit or Loss and Other Comprehensive Income for the Year Ended 31 December 2023

Statements of financial position as at 31 December 2023

Definition of terms

Gross profit refers to revenue minus cost of sales.

Gross profit margin corresponds to gross profit as a % of revenue.

Operating expenses corresponds to Selling and distribution expenses, Administrative expenses and Other operating expenses.

EBITDA refers to earnings before interest, tax, depreciation and amortization.

EBITDA margin corresponds to EBITDA as a % of revenue.

Operating profit refers to gross profit minus operating expenses plus other operating income.

Operating profit Margin corresponds to EBIT as a % of revenue.

Profit before Tax corresponds to EBIT minus net finance (cost)/income and plus share of profit of associates and joint venture using the equity method.

Profit before tax margin corresponds to profit before tax as a % of revenue. Return on equity corresponds to net profit reported to average total equity. Return on assets corresponds to net profit reported to average total assets.

Earnings per share is profit after tax from continuing operations reported to weighted average number of shares.

About BUA Foods Plc

BUA Foods Plc (NGX: BUAFOODS) is a leading food business with well diversified and scalable operations producing sugar, flour, pasta, rice and edible oils. The Company owns strategically located plants across Nigeria, in addition to a cordial alliance with local stakeholders in host communities. Additionally, BUA Foods is a resilient business built on a strong brand proposition and is an operator that has a well-known reputation for delivering high-quality products.

BUA Foods continues to invest in modern technology for efficient food production, innovatively expanding with strategic partners across the value chain. The Company is also well positioned to leverage significant export potentials across West Africa and the larger African continent.

Headquartered and listed in Nigeria, BUA Foods is one of the most capitalized companies on the NGX Exchange and a leading consumer goods firm by market value.

For more information visit https://www.buafoodsplc.com/overview/

BUA Foods posts 89% Gross Profit Increase, defies headwinds